Business failure is a common occurrence, and financial mismanagement is often the root cause. Poor financial planning, inadequate funding, and weak leadership are just a few of the reasons why firms fail financially. In this article, we will explore What Are The Three Most Common Reasons Firms Fail Financially?, providing insights into the dos and don’ts of financial management. We will analyse the importance of financial and non financial factors and how these factors can impact the success of a business. We will also provide tips and strategies to help businesses avoid common pitfalls. Whether you are a new entrepreneur or an established business owner, understanding the importance of all these factors whether financial or non financial it is essential for the long-term success of your business.

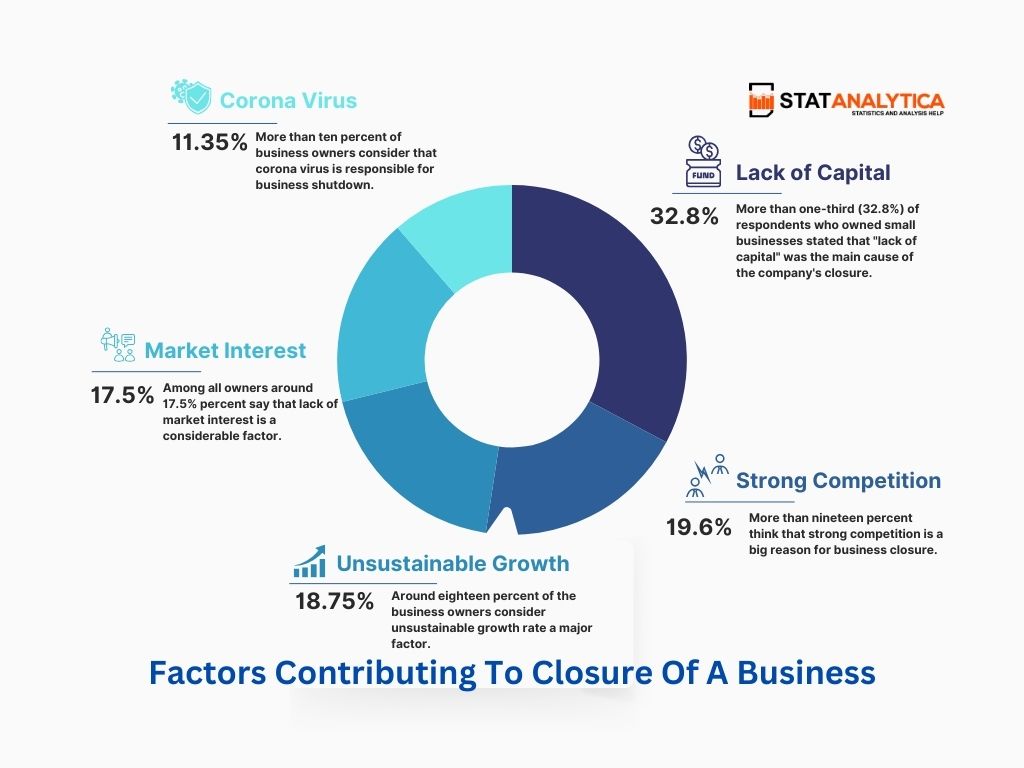

Factors Contributing To Closure Of A Business

Table of Contents

To gain a better understanding of the challenges, objectives, and driving forces behind becoming an entrepreneur, a national survey was conducted of past and present small business owners by a small business insurance comparison website. Although being the backbone of the American economy, small businesses fail by the thousands every year. Here are some stats that were revealed in the survey:

More than one-third (32.8%) of respondents who owned small businesses stated that “lack of capital” was the main cause of the company’s closure.

- Around twenty percent considered Intense competition (19.6%) as a primary factor.

- Almost nineteen percent considered an unsustainable growth rate (18.75%) for business closure.

- For some lack of market interest (17.5%) were additional factors contributing to firm closures.

- Only 11.35% of them cited COVID as the reason behind their company’s shutdown.

| Get 35% Off on Business Management Assignment Help. Expert Assistance for A+ Grades. Get Your Business Management Assignment Help Now! |

What Are The Three Most Common Reasons Firms Fail Financially?

Now we will jump on to the three most common reasons for a firm’s financial failure in depth. They are:

Poor Financial Management

Poor financial management refers to mishandling money matters within a business. It involves problems like overspending without control, not keeping track of where money goes, or not planning budgets wisely. When a firm has poor financial management, it might struggle to pay bills, manage debts, or invest in important things for the business. Essentially, it’s like not keeping a careful eye on your wallet or purse—money slips away without realising where it’s gone, leading to financial trouble for the company. Some common aspects of poor financial management that can lead to failure include:

- Failing to budget: A complete and sound budget is essential for keeping a business on track. Without effective budgeting practices, companies may underestimate their earnings and face financial difficulties.

- Poor bookkeeping and cash flow management: Inefficient financial record-keeping and ineffective cash flow management can lead to a cash crisis, which is often the cause of business failure.

- Underfunding: Inadequate financing or selecting the wrong type of funding for a business can put it on the path to failure.

Lack Of Market Demand

Lack of market demand means that not enough people want to buy what a company is selling. It’s like having a lemonade stand but nobody wants lemonade! When there’s a lack of demand, it could be because the product isn’t what people need or want, or maybe there are other similar things available that customers like better. So, a business might struggle to sell its products or services, leading to financial problems because they’re not making enough money from sales. It’s important for a company to understand what people want and need to make sure there’s enough interest in what they’re offering. Lack of market demand can be due to following reasons:

- Lack of Customer Interest: The firm’s products or services don’t catch the attention of enough people.

- Not Meeting Needs: The business fails to offer what customers really want or need.

- High Competition: There are too many other options available to customers, making it hard for the firm to stand out.

Inadequate Business Planning And Adaptation

Inadequate business planning and adaptation mean not preparing well or adjusting to changes in the business world. It’s like navigating through a maze without a map or being slow to change direction when the path changes. When a firm doesn’t plan properly, it might make decisions without thinking ahead, leading to problems. Also, if it doesn’t adapt to new trends, technologies, or shifts in the market, it can fall behind competitors. For example, not updating a store’s offerings when customers’ preferences change could lead to fewer sales. So, businesses need good plans to guide them and the flexibility to change course when needed to stay successful. Some common aspects of inadequate business planning that can lead to failure include:

- Ignoring Risks and Challenges: Not preparing for possible problems or unexpected situations that could affect the business.

- Stagnation and Resistance to Change: Being too rigid or unwilling to evolve with the changing business landscape.

- Failure to Innovate: Not coming up with new ideas or improving existing products/services to stay competitive.

Some Other Common Reasons For A Firm’s Financial Failure

After studying the main reasons for a firm’s financial failure there are some other reasons that also contribute to it and they are as:

Overexpansion or Rapid Growth

Overexpansion or Rapid Growth refers to a situation where a company grows too quickly or expands its operations beyond its means. While growth is typically seen as positive, expanding too rapidly can strain a firm’s resources, such as finances, manpower, or infrastructure.

Ineffective Marketing and Branding

Ineffective marketing and branding serve as high risk for firms, often leading to financial struggle and eventual failure. This issue arises when a company fails to communicate its value proposition or connect with its target audience. Ineffective marketing means the company might not reach the right people or convey why its products or services are worth buying. Similarly, poor branding can result in a lack of recognition, trust, or differentiation in the market, making it difficult to make and retain customers. This leads to lower sales, reduced market share, and an inability to compete effectively. Without a strong marketing strategy and compelling brand identity, firms face difficulty in capturing consumer attention and converting interest into revenue, ultimately impacting their financial stability and growth prospects.

Inefficient Operations and Processes

Inefficient operations and processes contribute significantly to financial failure within firms. This issue arises when workflows, systems, or production methods aren’t optimised, leading to wasted resources, increased costs, and delays. Inefficiencies can hinder productivity, inflate expenses, and compromise quality, impacting the company’s ability to compete. Without streamlined operations, firms struggle to meet demand effectively, resulting in lower profitability and potential financial downfall.

Legal and Regulatory Issues

Legal and regulatory issues pose substantial financial risks for firms. When businesses fail to comply with laws or face lawsuits, fines, or penalties, it makes them suffer with unexpected expenses. These issues disrupt operations, damage reputation, and often demand substantial resources to resolve. Legal battles and non-compliance not only drain finances but also affect consumer trust and market standing, leading to decreased revenue and potential financial collapse.

Poor morale

Poor morale within a firm significantly impacts its financial health. When employees feel disengaged, demotivated, or undervalued, it affects productivity and performance. Low morale can lead to higher absenteeism, increased turnover rates, and a decline in the quality of work. This lack of enthusiasm and commitment among the workforce directly impacts the company’s ability to innovate, deliver quality products/services, and ultimately affects its bottom line, contributing to financial instability and potential failure.

Dos and Don’ts to avoid a firm’s financial failure

Let’s explore a precise guide outlining the crucial Dos and Don’ts when a firm encounters financial difficulties. These principles serve as a compass, guiding decisions and actions during times of financial turbulence, aiming to pave the way toward stability and success.

Dos:

Seek Professional Guidance: Do consult financial experts or advisors to assess and strategize solutions for the financial issues.

Review and Adjust: Do analyse the company’s financial situation regularly and make necessary adjustments to spending, operations, or strategies.

Focus on Core Strengths: Do emphasise and invest in the company’s strengths or profitable areas to stabilise finances.

Communicate Transparently: Do communicate openly with stakeholders, employees, and partners about the financial challenges and the steps being taken to address them.

Explore New Revenue Streams: Do consider diversifying products, services, or markets to generate additional income sources.

Prioritise Cash Flow: Do prioritise maintaining healthy cash flow to meet immediate financial obligations and sustain operations.

Negotiate and Collaborate: Do negotiate with creditors or suppliers for extended payment terms and explore collaborations to reduce costs.

Don’ts:

Ignore Financial Red Flags: Don’t ignore warning signs or delay action when financial issues arise; early intervention is crucial.

Rely Solely on Debt: Don’t solely rely on borrowing to address financial problems; it can exacerbate the situation without a sustainable plan.

Make Impulsive Decisions: Don’t make hasty or emotional decisions; take time to assess options and their long-term impacts.

Cut Essential Investments: Don’t slash investments in critical areas such as innovation, quality, or customer service that contribute to long-term success.

Lose Sight of Customers: Don’t neglect customer relationships or satisfaction during financial struggles; they are crucial for recovery.

Blame Game: Don’t indulge in blaming individuals or departments for financial setbacks; focus on solutions instead.

Avoid Seeking Help: Don’t hesitate to seek assistance or advice from professionals or mentors during challenging times; pride should not hinder recovery efforts.

Conclusion

In the ever-changing world of business, understanding why firms face financial struggles is key to their survival and after seeing what are the three most common reasons firms fail financially?. By recognizing the common reasons poor financial management, lack of market demand, and inadequate planning we shed light on paths to avoid financial downfalls. Learning from these challenges, firms can strengthen their financial foundations by managing money smarter, listening closely to what customers want, and staying adaptable to change. With these insights, businesses can pave a more secure path toward success, ensuring a brighter, more stable future.